The Spanish Association of Fintech and Insurtech (AEFI) releases the latest statistics on Spain’s insurtech sector, and the industry will generate 1,500 new jobs in 2019 thanks to a number of factors.

“2019 will be the year of the consolidation […] that will generate 1,500 jobs”

Rodrigo Garcia de la Cruz

“Insurtech is an emerging sector that expands the range of possibilities thanks to innovative business models that respond to the new needs of social reality,” said Rodrigo García de la Cruz, president of the AEFI.

“Undoubtedly, 2018 has been the year in which the agreements between Insurtech startups and the big players have begun to take place in a generalized way, and 2019 will be the year of the consolidation of these relationships that will generate 1,500 jobs,” he added.

Read More: Mapfre launches insurtech startup accelerator in Madrid

The AEFI study on insurtech in Spain counted on the participation of 13 companies that were surveyed:

- bdeo

- Brokalia

- Clicksurance

- Gistek

- Livetopic

- Microaltor

- Mi Legado Digital

- Pensumo

- PuntoSeguro

- Segguroo

- Seguros Veterinarios

- Tech4Insurers

“2019 will be the year of open innovation in which we will see the big insurers bet decisively for insurtech companies in Spain”

In 2018, these companies combined reached more than one million active clients and signed a total of 60 agreements with the big insurers.

Read More: Mi Legado Digital to Manage a Living Will and Testament on the Blockchain

Igor Fernandez

“2019 will be the year of open innovation in which we will see the big insurers bet decisively for insurtech companies in Spain,” said Igor Fernández, CEO of Segguroo.

According to the statistics presented on Wednesday at the headquarters of the Ministry of Economy, Employment and Finance of the Community of Madrid:

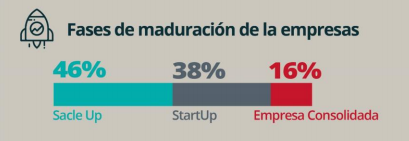

- 16% of companies surveyed are considered consolidated companies

- 38% are startups

- 46% are scale-ups, that is, companies with more than three years of operation and a growth rate of annual employment equal to or greater than 20%

In this sense, the surveyed companies had a total of 241 employees and during the year 2017 reached 17% growth in terms of the number of employees.

David Navarro

“During 2018 it has been shown that the trend of our vertical was met: the first consolidated companies and the birth of new proposals with strong financial support,” said David Navarro, who is responsible for the insurtech vertical at AEFI.

“The challenge continues to be to reduce the barrier of integration with insurers, both in terms of time and technology,” he added.

Juan Betés Novoa, CEO of PuntoSeguro, shared some his company’s stats during the first discussion table entitled ‘Are we able to insure young people?’

Juan Betés Novoa

“Only 25% of our clients with life insurance are under 40 years old. However, in the #RetoPuntoSeguro, which includes those insured who are rewarded for their physical exercise, those under 40 already represent 35% of the insured, 10% more.

“The reflection I make is that, apart from improving premiums and optimizing the user experience of our sites, if we want to convince young people, there is no better strategy than designing personalized products that reward their actions and that can be used every day.”

For Alejandro Mariño, Co-founder and CEO of Livetopic, “Struggling to informationally empower the client must be one of our priorities as a sector.

Alejandro Mariño

“The historical lack of education and financial culture on the part of the different generations of Spaniards (millennials, generation X …) makes us stand at the tail of Europe in selling savings and insurance products.

“If we promote and improve financial education around the world, the typical client will be more aware of the importance of planning their financial future and that will make the sector grow and transform by and for the client.”

Alejandro Marín, CEO of Brokalia, explained during the second panel discussion entitled ‘Connectivity with insurers’ that “in recent years, the advance of EIAC (Information Exchange Standard) has facilitated an improvement in connectivity among those who store information (the insurance companies) and the Insurtech that want to bring it closer to the users.

Alejandro Marín

“Once this road has been started, the priority must be to reach its destination as soon as possible and, for this, it must have the largest number of actors that help define the best of the models. In this sense, the AEFI can contribute to establish the standard and its phases of implementation.”

On the other hand, Jose Lizarraga, commercial director of Gistek Insurance, pointed out that “the digitization process has not yet penetrated too deeply into the claims management of the large insurers.

Jose Lizarraga

“The use made by the Insurtech of digital tools helps to comply with the obligations of the General Data Protection Regulation (GDPR), since it allows to centralize the information, giving remote access to all the documentation of the accident only by entering a file number, avoiding unsafe channels. ”

AEFI is the main representative association of the Fintech and Insurtech sector in Spain. Its mission is to collaborate, innovate and promote Spain as a pioneering focus of Fintech and Insurtech, build bridges in the Spanish Fintech ecosystem and promote interaction between the main players in the market.

The objective of the AEFI is to create a favorable environment for the development of Fintech and InsurTech startups and companies in Spain, performing interlocution, communication and collaboration tasks with the organizations and relevant agents of the system to strengthen their growth and their ecosystem.

A word from our Sponsor: Looking for Content Marketing support? Click here.