This is a guest post written by Philippe Gelis, CEO and co-founder of fintech and FX startup Kantox.

Fintech is probably the hottest tech subsector nowadays, and the financial industry is probably the last large industry that has not been already really disrupted.

We are now experimenting with the first wave of fintech, which will see companies competing with banks on specific verticals: loans and credit, payments, foreign exchange and remittance, wealth management and many more. Lending Club is far and away the global flagship fintech company.

Banks are getting pressured by newcomers but –and the “but” is really important– these disrupters are relying on old-school banks for banking services and banking infrastructure (bank accounts, payments, compliance, brokerage, etc). In other words, they are re-inventing the user experience, the user interface or the business model but not “the whole thing” (to steal a quote from Marc Andreessen) and they stay at the mercy of banks.

It is important to note that many fintech businesses have evolved from pure “P2P models” to “marketplace models” (to steal a quote from Foundation Capital Partner Charles Moldow) where the liquidity can come from peers or from financial institutions. Lending Club is known for getting up to 80% of its liquidity from financial institutions and not from peers. Anyway, the challenge is more in having deep liquidity than in locating the liquidity.

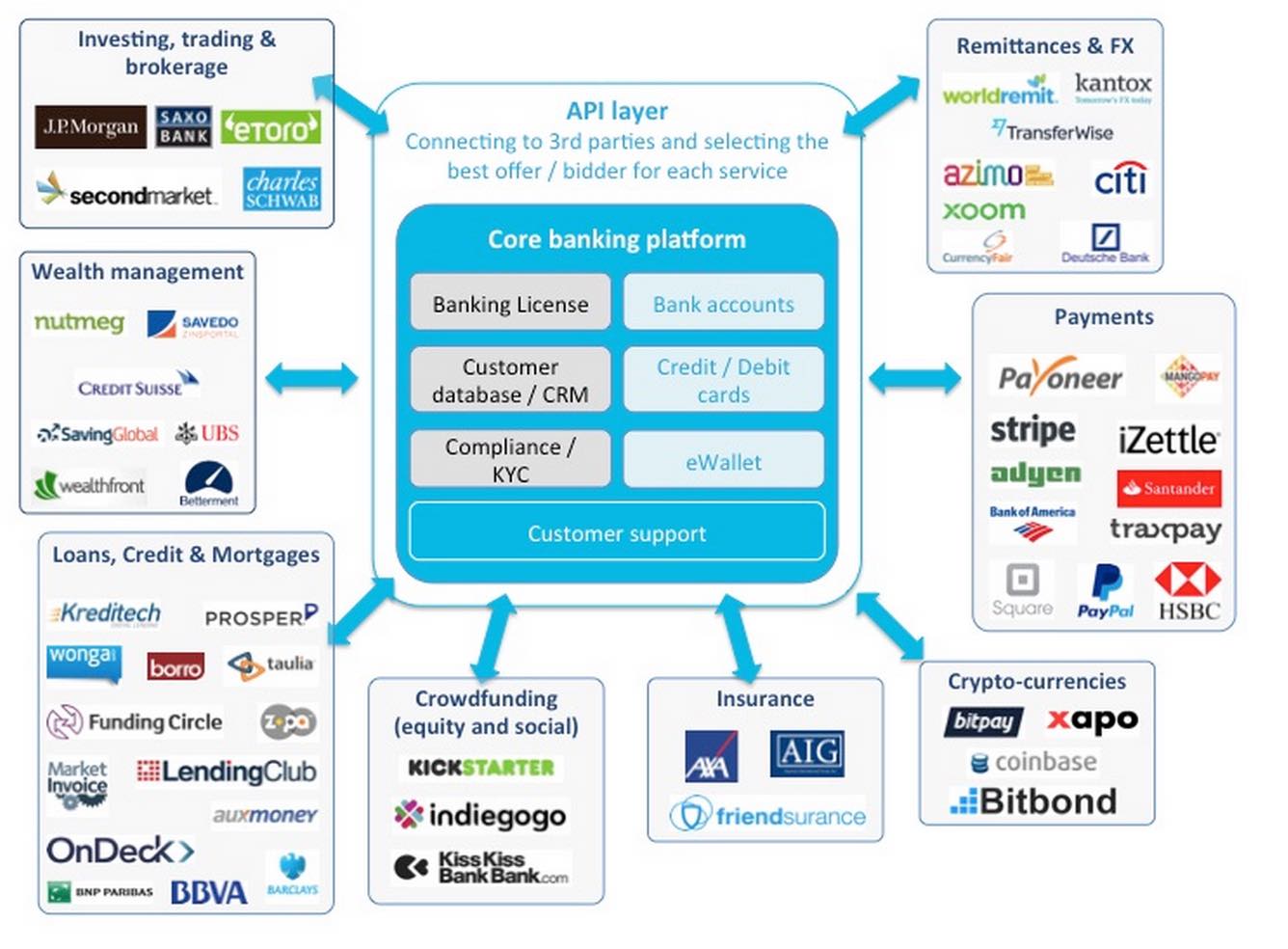

The second wave of fintech, to come in 2 to 5 years’ time, will be “marketplace banking” (or “fintech banks”). This will be a type of bank based on five simple elements:

- A core banking platform built from scratch.

- An API layer to connect to third parties.

- A compliance/KYC infrastructure and processes.

- A banking license, to be independent from other banks and the ability to hold client funds without restrictions.

- A customer base/CRM, meaning that the fintech bank will own the customers, and a customer support team.

The products directly offered by the fintech bank will be limited to “funds holding”, comprised of:

- Bank accounts (multi-currency).

- Credit and debit cards (multi-currency).

- eWallet (multi-currency).

All others services (investing, trading & brokerage; wealth management; loans, credit & mortgages; crowdfunding (equity and social); insurance; crypto-currencies; payments; remittances & FX; this list is not exhaustive) will be provided by third parties through the API, third parties including both old-school banks, financial institutions and fintech companies.

Imagine that you are a client of this “marketplace bank” and that you need a loan. You do not really care if the loan is provided to you by Lending Club or Bank of America, what you look for is a quick and frictionless process to get your loan, and the lowest interest rate possible. So, through the API, the “marketplace bank” will consult all its third parties and offer you the loan that best suits you.

We can imagine both a process in which conditions offered by third parties are non-negotiable but we can also imagine a competitive bidding process to get the best offer for each client at any point in time.

I have been asked several times about this business model and I think it is a no-brainer. It is a simple mix between an access fee to the “marketplace bank” and a revenue sharing model with the third parties providing additional services.

The beauty of “marketplace banking” is that it competes directly with banks on core banking services without the need to build all the products.

Now the question is, what is really needed to launch a “marketplace bank”?

- Technology/API/Compliance/KYC: building the technology is a complex part but many people have the skills to do so. So it is definitely not the main barrier.

- Banking license: in Europe, the budget to get a banking license is estimated at approximately €20 million, though it could cost less or more, depending on the country. But it is not only about money. To be in business you need strong and experienced board members, without them regulators will probably not give you the green light. So this means that you need to be able to convince investors and board members to trust you based on a Powerpoint presentation and to bet big on you. I think that we need the first wave of fintech to be successful, with some exits and big returns, to have people betting a lot of money on “marketplace banking”. As an entrepreneur you need to have demonstrated that you are able to execute and scale a fintech business to lead that kind of new venture.

- Customer base/CRM: here is the most complex part. How do you attract a critical mass of customers based on a simple offering (accounts + cards + eWallet) that relies on third parties for additional services? You cannot only rely on marketing and having a cool brand to attract hundreds of thousands of new customers if you have nothing really differential to offer. You also need some kind of focus: will you target individuals or businesses? Lower end or high net worth individuals? Small, medium or large businesses? Will you focus on one single country or several ones? As always, it is all about customers and revenues, so you need a clear sales and marketing plan to quickly scale the customer base. I have some ideas how to do it but I will keep it for another post.

I have been asked several times if the first “marketplace bank” will be launched by an old-school bank (an incumbent) or a fintech startup? I definitely think the latter. It is too disruptive and the risk of cannibalization is too high to see a bank assuming the risk.