Spanish ticketing company Ticketea has hit a big milestone. The company founded by Javier Andres in 2010 has just reached €100 million in gross sales. “We’re pleased we’ve got to this stage and expectations for the remaining of the year are very positive”, Javier said in a phone conversation.

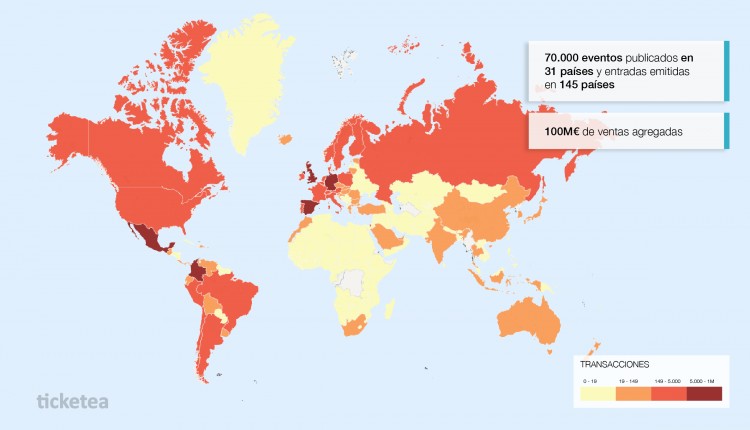

The company currently has offices in six European cities and claims that more than 70,000 events have been created on its platform and customers from 145 countries have purchased tickets through the site.

Following a €3 million investment from Seaya Ventures in 2013, the company has been in a relative acquisition spree as of late, buying Telemaco Sistemas, Telentrada and most recently Germany’s TodayTickets. And it is precisely in Germany, the UK and other international markets where Ticketea sees a big growth opportunity.

International expansion and other areas of growth

“To start our expansion we launched in two of the most complicated markets out there, the UK and Germany”, Javier says. “Things are going well and in less than a year these two countries will represent 10% of our sales”. Ticketea’s CEO says that this expansion has only started and that in coming months they plan to, once again, study the launch of their services in Latam, where Seaya has a lot of experience with other portfolio companies such as SinDelantalMX, Cabify or ComparaGuru.

Ticketea makes money by charging a small commission (usually of 10%) on each sale, which means that €100 million in sales equals to approximately €10 million in net revenue. Creating new events on its platform is free, and the company only charges clients when these decide to run paid events. The five year old platform houses all kinds of events, but in recent years its music and theatre business has increased significantly.

And the company is now looking for more areas of growth, outside and inside Spain.

Javier explains that Ticketea wants to become much more than just a site where their own customers buy tickets, and to achieve that they’re planning on building what he describes as a ticketing marketplace. “Think about what Amazon does, allowing others to leverage their infrastructure and reach to sell their own products. We want to do something similar within our industry”, he explains.

This means that third parties who are interested in integrating their inventory with Ticketea will be able to do so, thus taking advantage of the company’s reach, database of clients and brand. This move would push Ticketea towards also becoming a sort of aggregator of ticketing services.

“In this business it’s hard to just be an aggregator, because commissions are very low. However, if you combine this with a proper ticketing business like ours, good things can happen”, Javier adds confidently.

It’s all about monetising the platform that Ticketea has built over the past few years.

Could selling last minute tickets be another area of growth? He’s not so sure about it. “I think last minute ticketing is a great future within a bigger business, but not a product per se. It’s interesting for the end user, but I don’t think it’s enough to build a big company around it due to low margins”.

Besides expanding internationally and becoming a marketplace of sorts, the company claims to also see an opportunity in integrating secondary and primary markets. “The barriers that separate these two markets are becoming thinner by the day”, he says. The idea is that once an event is sold out, companies can offer visitors the possibility of buying tickets through secondary ticketing platforms such as Viagogo or Ticketbis. Ticketmaster already does this with Seatwave.

“We don’t see ourselves entering the secondary market, but we’re interested in exploring the possibility of integrating someone else’s secondary inventory”, he adds.

A red hot industry

These are interesting times in the ticketing business, with big rounds of funding and acquisitions happening almost every month. London-based Songkick merged with CrowdSurge in June and raised a $16 million round, Pandora acquired Ticketfly for $450 million and Seatgeek received a $62 million investment. In Spain, Entradas.com got bought by Germany’s CTS Eventim in 2014.

“There’s a lot of momentum in the sector”, Javier says. “Our focus right now is on growing internationally and opening new areas of business. Spain is already profitable for us, but we have a long way to go”.

Does exploring these growth opportunities mean that the company will be raising funds soon? “Not necessarily. We don’t want to close any doors and we’re looking at various ways to push the gas pedal”, he notes.