Spanish startup BDi Group specializing in biotechnology closes an investment round of €3.9 million to further support its international expansion and develop relationships with top-tier companies.

With offices, laboratories, and plants in the Parque Tecnologico de Boecillo in Valladolid, BDi has maintained a level of sustained growth that has allowed it to position itself as a benchmark in its sector, according to El Confidencial.

Pablo Gutierrez

“Our value is based on scientific excellence and an in-depth knowledge of the markets in which BDi operates. In uniting technical competencies with the demands of the market, we can guide effective research for our clients,” said Pablo Gutiérrez, CEO of BDi.

The Spanish startup has received an injection of €1.9 million led by American biotechnology company Dyadic International Inc. — an investment group specializing in biotechnology, along with Inveready Technology Investment (‘Inveready’), in addition to securing €2 million in research contracts.

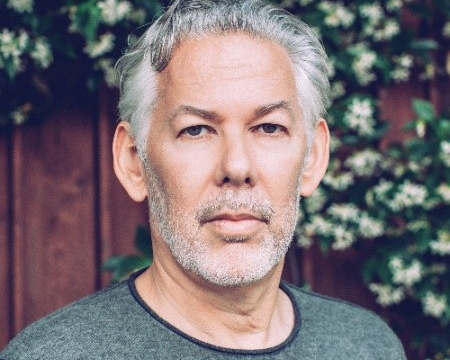

Mark Emalfarb

“We are very excited about our collaboration with BDi,” said Mark Emalfarb, Founder and CEO of Dyadic, adding, “they are an excellent research partner that will help us further develop our C1 platform for overexpression of useful genes in the development of biological pharmaceuticals and lower cost vaccines for the human and veterinary health markets.”

BDi Group is a customer-centric company with a strong background in providing solutions in two sectors: health and food.

Health and food services include:

- Process development

- Scale up, industrialization

- Contract Manufacturing

“We have assembled a technically trained and experienced team that has an excellent track record in research, development and marketing of products, which has attracted a strategic partner and investor from the United States, Dyadic and the venture capital firm, Spanish Inveready,” added BDi CEO Gutierrez.

Having offices in Madrid, Barcelona, and San Francisco, Inveready has seven funds and invests both Equity and Venture Debt in technology companies, with high growth potential and innovative business models. The VC has more than 80 portfolio companies that are leaders in their respective markets, and it also invests in quoted continental European companies with “hybrid quasi equity instruments through a dedicated fund,” according to its website.