(This post was written by Javier Escribano, former co-founder of TouristEye and Selltag, and originally published on Medium. Javier is currently seeking a VP of Product, CTO or PM role. You can check his LinkedIn profile or contact him if interested)

I have raised 3 rounds of seed investment (~700k€ in total), no Series A yet; so my advice is limited by that experience. However, it’s consistent with the experience of other founders with more experience I talked with.

The key learnings on this article are:

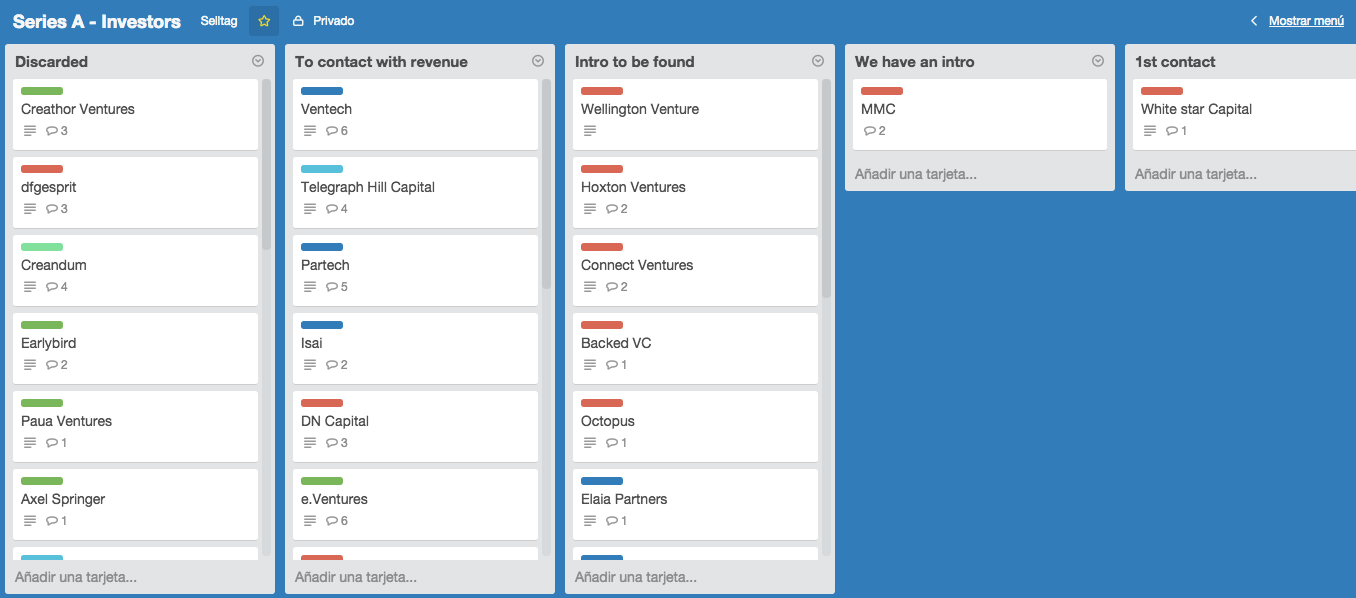

- Plan your investment process with a board in Trello

- Always find an intro

- The pitch must be a conversation, not a monologue

- Build three different decks, one for each stage of the process

- Use Demo Days to strengthen the company brand

Plan your investment process with a board in Trello

I recommend you to have a Trello board for each round of investment. Add all the investors you want to talk to and then, move them through this funnel:

- Discarded: Investors who have rejected you or you have discarded (they have invested in a competitor for example).

- To contact later: Investors who are interested but need to see more months of data.

- Intro to be found: You need to find someone who knows the investor.

- We have an intro: You know someone who can make an intro.

- 1st contact: You have talked with them once.

- 2nd contact: You have talked with them twice or more.

- Want to invest: Investors who want to invest.

You should add the main information of the investor in the description of each card (range of investments, total investment per company, companies invested, people you know who can make an intro). Each time you have an interaction with them, add a comment on the card with their feedback or your impressions. That way, your co-founders can see the evolution and you don’t need to keep forwarding emails.

Always find an intro

I’m sure you have already read this tip in many places, so consider it another reminder that it does work way better to have an intro than to send a cold email or call.

Sometimes is hard to find someone who knows the investor, but you can always find a way. Of course, you can use LinkedIn; although be careful because lots of connections are really poor links. Before asking someone to make you an intro, ask him/her how good do they know the investor. Not all intros are worth the same 😉

Another way is to meet someone who knows the investor; and the best people are probably the founders/CEOs of the companies he/has invested in. You should ask someone you know for an intro to that founder (a cold email/tweet may work too), ask him/her for advice on investment/roadmap over coffee and then ask him/her if he/she thinks his/her investor is a good match for you. If he/she thinks so, there you have a good intro!

The pitch must be a conversation, not a monologue

This is a typical mistake we do when we talk to investors. We try to communicate everything, assuring the investor we know everything about our business, we have a clear roadmap and we are the best team to achieve it.

However, it’s not the best way to convince an investor. You have to make him/her engage with you intellectually, you want him/her to ask you questions you know the answer, you want him/her to get into the problem you are solving really deeply so he/she keeps thinking about it for the next days.

If it’s a monologue, he/she will not remember. If you make him/her think about it and engage with the problem; you will in a better position to convince him/her. Take into account that when you are talking to an investor, your competitors aren’t the company competitors but other startups which are also raising and talking with him/her. The investor can only invest in a few per year, and he/she will end up comparing deals.

Build three different decks, one for each stage of the process

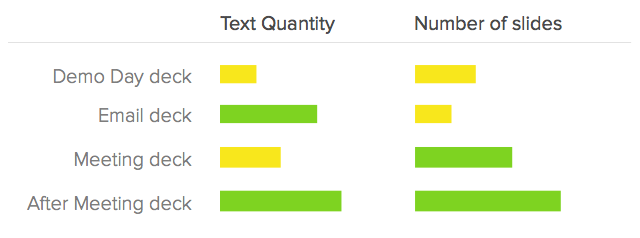

I recommend you to have 3 different decks:

Intro deck

This is the deck you will send over email to an investor to check if he/she is interested. It should have 10–12 slides, with key information about the team, problem, key parts of the solution and your metrics. Slides should be simple, with 1–3 phrases per slide; the investor will glance over them to see if it’s worth spending time on you.

Meeting deck

There are investors who prefer to talk on the meeting instead of following the script of your deck; and there are others who prefer to follow the deck and then ask you questions.

In both cases you will need a deck with much more information that the Intro deck but removing the phrases you are going to say. Remember they should look at you 80% of the time, not to the slides.

If you follow the deck on the meeting, you shouldn’t show all the slides. Leave many of them at the end, specially the ones which dig deeply into a topic (user acquisition, patents, tech…). If the investor asks about it, you have the slide. You will earn two points: one for being brief on the pitch and another for having the information prepared.

After meeting deck

Investors will ask you for the Meeting deck. You can’t send it because it doesn’t have the key phrases you said. You need to add those key phrases into the deck and reorganize it a bit so it follows a logical order (no just-in-case slides at the end).

Extra: Demo Day deck

This deck is like the Meeting deck but with just the slides you are going to pitch. You may need to remove text from it to make sure everyone looks at you 80% of the time (if people read the slide instead of listening to you, you have failed as a presenter).

We can summarize them:

Use Demo Days to strengthen the company brand

Don’t think Demo Days or public pitches will bring you an investor just after the pitch. It doesn’t happen. The only place I’ve personally seen it was in a 500 Startup Demo Day in Silicon Valley, when a founder of another startup received a text just after finishing her pitch saying he wanted to close the round with $100k. But the truth is that she had already talked him over email. I’m sure there will cases, but they are just 0.01%.

What you need to do in those pitches is strengthen the company brand so investors and potential new employees remember your company later; andmake sure everyone who listen will agree that you seem to be a trustworthy and reliable CEO. If you do, they will be more predisposed to meet with you even if it’s a cold email or call.

Enjoy the show and have fun, but don’t worry too much. The best startups almost never were the best ones in Demo Days anyway.

Photo | Alexas Fotos